A new report from Chainalysis finds that stablecoins like Tether, tied to the value of the US dollar, were used in the vast majority of crypto-based scam transactions and sanctions evasion in 2023.

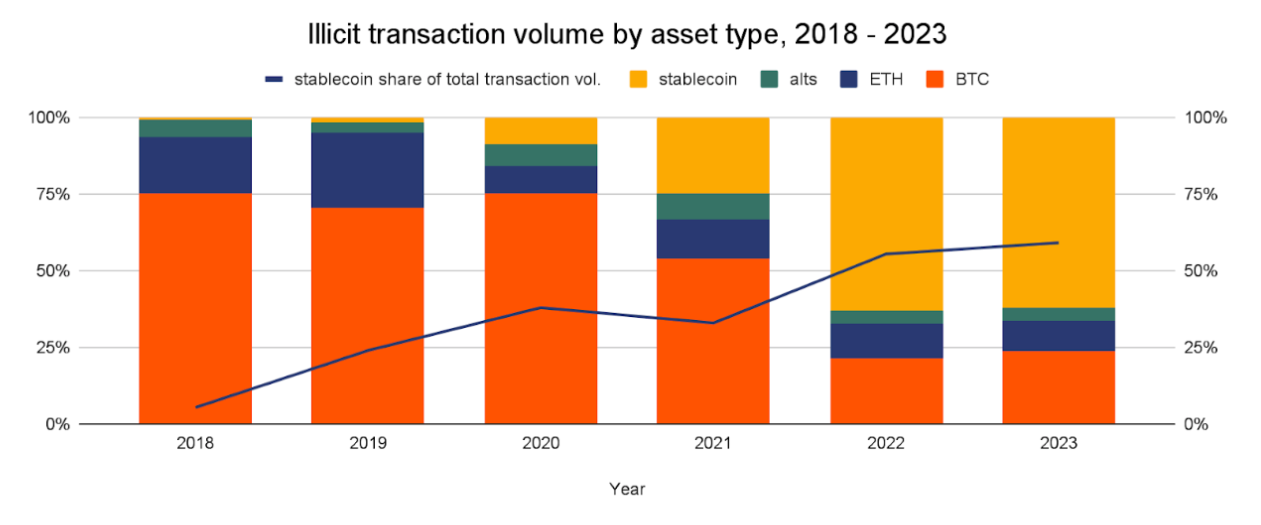

Stablecoins, cryptocurrencies pegged to a stable value like the US dollar, were created with the promise of bringing the frictionless, border-crossing fluidity of Bitcoin to a form of digital money with far less volatility. That combination has proved to be wildly popular, rocketing the total value of stablecoin transactions since 2022 past even that of Bitcoin itself.

According to a new analysis from Chainalysis, the great majority of crypto-based scam transactions and sanctions evasion in 2023 involved stablecoins like Tether, which are reliant on the value of the US dollar.

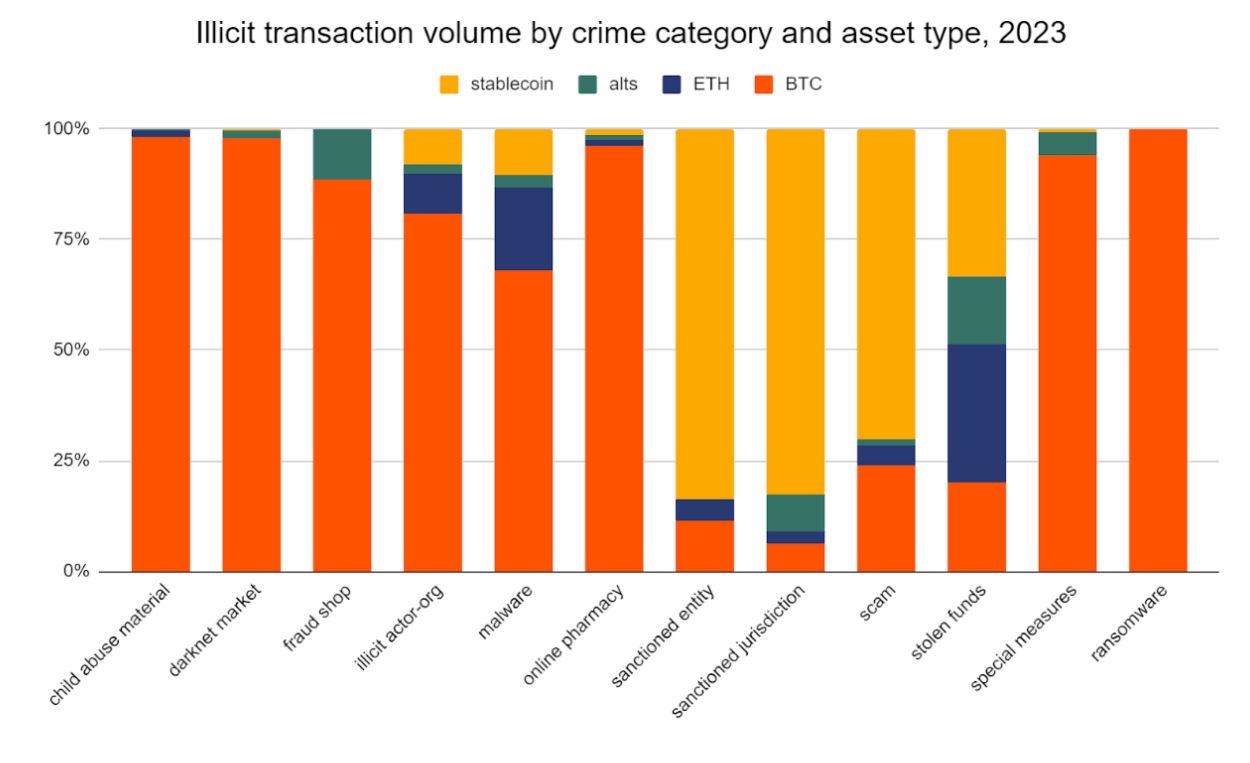

As part of its annual crime report, cryptocurrency-tracing firm Chainalysis today released new numbers on the disproportionate use of stablecoins for both of those massive categories of illicit crypto transactions over the last year. By analyzing blockchains, Chainalysis determined that stablecoins were used in fully 70 percent of crypto scam transactions in 2023, 83 percent of crypto payments to sanctioned countries like Iran and Russia, and 84 percent of crypto payments to specifically sanctioned individuals and companies. Those numbers far outstrip stablecoins’ growing overall use—including for legitimate purposes—which accounted for 59 percent of all cryptocurrency transaction volume in 2023.

Chainalysis calculated that illegal stablecoin transactions in 2022 and 2023 totaled $40 billion. Sanctions evasion constituted the greatest category of that stablecoin-enabled crime. In fact, of the $24.2 billion in illicit transactions that Chainalysis saw in 2023, more than half were the result of sanctions evasion across all cryptocurrencies, with stablecoins accounting for the great majority of those transactions.

According to Chainalysis’ head of sanctions strategy Andrew Fierman, stablecoins appeal to sanctioned individuals and nations alike since they make it impossible for the targets of the sanctions to be denied a stable currency such as the US dollar. “There’s a benefit to the stability of the US dollar that people are looking to obtain, whether it’s an individual located in Iran or a bad guy trying to launder money,” says Fierman. Stablecoins become an intriguing option if you live in a country where sanctions prevent you from accessing US dollars.

Fierman cites two prominent cryptocurrency exchanges as examples: Garantex, a renowned Russian exchange that has been officially sanctioned for its extensive illicit use, and Nobitex, the largest exchange operating in Iran, a country under sanctions. According to Chainalysis, there is a 9:1 ratio of stablecoin usage on Nobitex compared to bitcoin usage, and a 5:1 ratio on Garantex. That contrasts sharply with the roughly 1:1 ratio that Chainalysis found when comparing stablecoins and bitcoins on a few mainstream, unapproved exchanges.

Fierman cites two prominent cryptocurrency exchanges as examples: Garantex, a renowned Russian exchange that has been officially sanctioned for its extensive illicit use, and Nobitex, the largest exchange operating in Iran, a country under sanctions. According to Chainalysis, there is a 9:1 ratio of stablecoin usage on Nobitex compared to bitcoin usage, and a 5:1 ratio on Garantex. That contrasts sharply with the roughly 1:1 ratio that Chainalysis found when comparing stablecoins and bitcoins on a few mainstream, unapproved exchanges.

Chainalysis admits that certain cryptocurrencies, such as Monero and Zcash, are intentionally difficult or impossible to track via blockchain analysis, and as such, their analysis is not included in the study. Additionally, it states that it based its calculations on the kind of cryptocurrency that was given straight to an illegal actor, which might exclude other currencies that are frequently used in money laundering operations that switch between different types of cryptocurrencies to impede tracking.

The results of Chainalysis follow another study that was published this week by academics from the United Nations on the disproportionate role that stablecoins play in scams and illicit gaming throughout East and Southeast Asia. The UN report singles out Tether, the most widely used stablecoin, whereas Chainalysis declined to separate out the value of any specific stablecoin in its conclusions. According to the research, Tether is the “preferred choice for regional cyberfraud operations and money launderers alike because to its stability and the convenience, anonymity, and low fees of its transactions” when transferred through the TRON blockchain-based payment network.

Erin West, a deputy district attorney for Santa Clara County, California, and a member of the REACT High Tech Task Force who has long focused on crypto crime, claims that scammers frequently use Tether as a means of defrauding victims of “pig butchering” scams, in which they typically trick users into sending funds into fraudulent investments. “It’s Tether, always, always, always.” West claims, “I’ve never heard of pig butchering that isn’t Tether.” These con artists are unable to take a chance on any other coin’s volatility, such as ether or bitcoin. Their only goal is to transfer assets from the victims to themselves in the quickest, least expensive manner feasible.

According to West, the high percentage of stablecoin use in sanctions evasion is also a concerning development since it jeopardizes the framework that is intended to hold certain nations, people, and businesses accountable for transgressions of international law and criminal activity. “It’s extremely risky,” West remarks. It gives them access to the exact money units that we are attempting to keep them from having. Sanctions are designed to prevent precisely this, but they manage to get around it.

When The Fox Daily asked Tether Holdings, the business that creates the stablecoin bearing its name, for comment, they didn’t reply. However, Apple has refuted other claims that Tether is being used for illegal activities and to evade penalties. The corporation contended that an October Wall Street Journal story concerning the topic was founded on “extremely inaccurate analyses of data”; nonetheless, in that instance, the company cited Chainalysis results as a more precise report. Tether Holdings responded to the WSJ piece on October 26 with a blog post stating, “There is simply no evidence that Tether has violated Sanctions laws or the Bank Secrecy Act through inadequate customer due diligence or screening practices.”

Tether may freeze user assets, unlike most cryptocurrencies. Since its start in 2014, it has frozen $835 million in funds that it believes are connected to illegal activity, the company stated in a blog post from October. Transparency, compliance, and proactive cooperation with pertinent authorities worldwide are key to Tether’s ethos, the business stated.

More enforcement might help put an end to criminals’ exploitation of stablecoins, according to Chainalysis’ Fierman, who also notes that Tether’s efforts to freeze illicit funds are having an effect. According to Fierman, “illicit activity gets pushed to the fringes, just as we’ve seen with compliant exchanges dominating more and more of total transaction volumes.”

According to Fierman of Chainalysis, more enforcement may put a stop to criminals’ exploitation of stablecoins, and Tether’s efforts to freeze illicit funds are having an effect. Fierman claims that illegal activity is driven to the periphery as conforming exchanges account for an increasing percentage of all transaction volumes.

More enforcement might help put an end to criminals’ exploitation of stablecoins, according to Chainalysis’ Fierman, who also notes that Tether’s efforts to freeze illicit funds are having an impact. Illegal activity is driven to the periphery, according to Fierman, “just as we’ve seen with compliant exchanges dominating more and more of total transaction volumes.”

Connect with us for the Latest, Current, and Breaking News news updates and videos from thefoxdaily.com. The most recent news in the United States, around the world , in business, opinion, technology, politics, and sports, follow Thefoxdaily on X, Facebook, and Instagram .