In Short

- Biden administration officials revealed details of a new proposal to cancel student loan debt.

- Millions of americans could experience debt relief starting this fall.

- The proposal is pending finalization and approval, with potential legal challenges ahead.

- If implemented, about 70% of federal student loan debtors could see their debt lowered or canceled.

- Biden’s previous student loan forgiveness plan was struck down by the supreme court, leading to a second attempt at broad student debt relief.

- The new plans aim to benefit over 30 million americans, complementing existing measures for student loan forgiveness.

TFD – Explore the Biden administration’s groundbreaking proposal for student loan debt relief, offering potential relief to millions of Americans. Get insights into the key details of this new plan, including debt cancellation and student loan forgiveness, and stay updated on the evolving landscape of student loan policies and initiatives.

The outlines of a new proposal to cancel student loan debt were revealed by Biden administration officials on Monday, and it looks like millions of Americans could begin to experience debt relief as early as this fall.

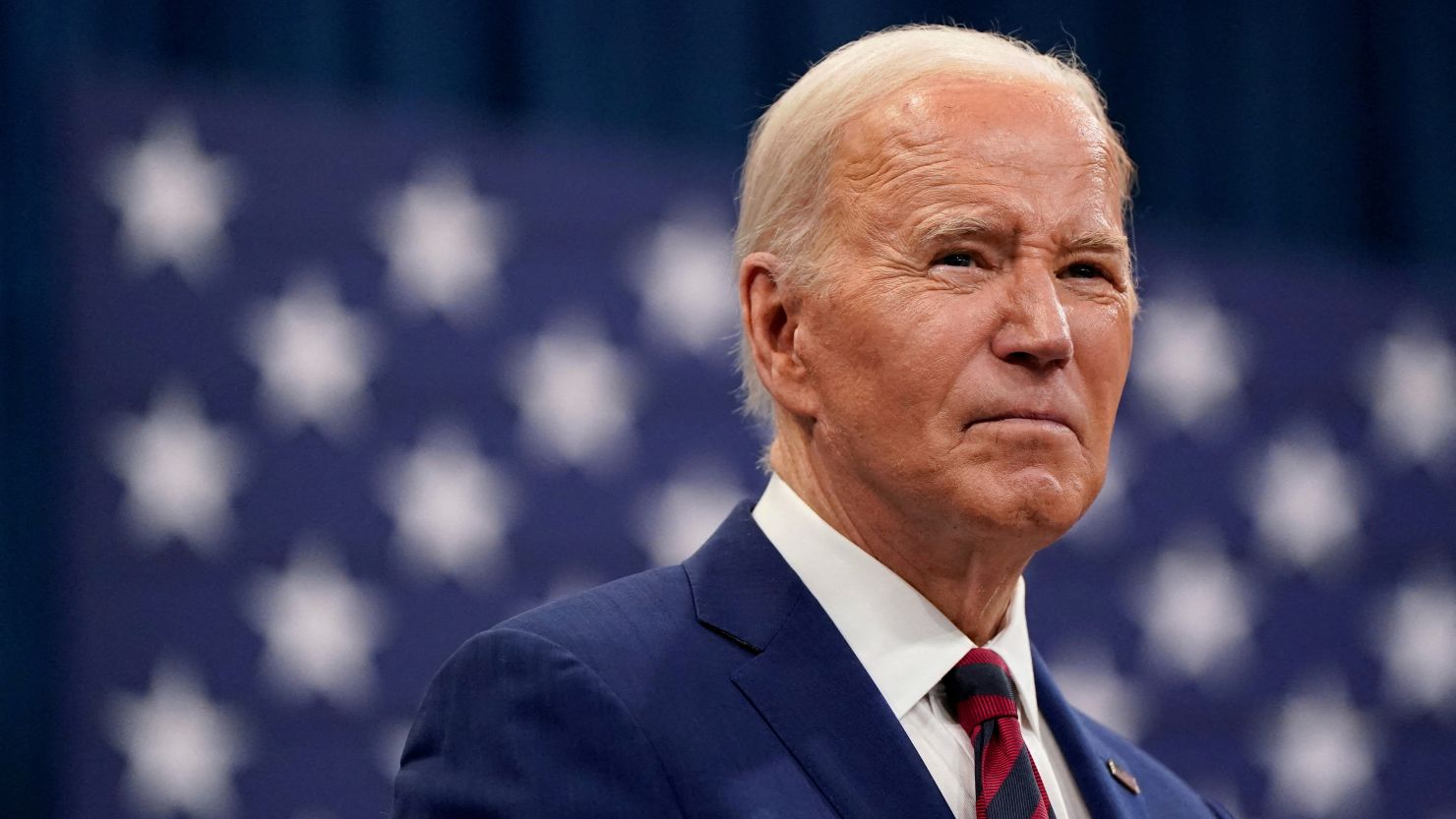

Finalization of the new set of plans is still pending, as TFD reported on Friday. It’s President Joe Biden’s second attempt to implement broad student loan forgiveness after his first plan was struck down by the Supreme Court last summer. On Monday, the president will make the announcement in Wisconsin, a crucial swing state in November.

As to the White House fact sheet, over 30 million Americans would gain from the new policies in addition to the more targeted measures already implemented by the Biden administration to waive student loan debt.

This indicates that as a result of Biden’s initiatives, about 70% of all federal student loan debtors would have their debt lowered or completely canceled.

However, the proposals must first be approved, which may take many months, and they must pass any prospective legal challenges.

Biden’s latest plans for student loan forgiveness may provoke further conflict with Republicans. Regarding the initial student forgiveness program, a number of states and organizations led by conservatives filed lawsuits against the Biden administration, claiming the executive branch had overreached its jurisdiction.

During a call with reporters on Sunday, White House press secretary Karine Jean-Pierre stated, “President Biden will use every tool available to cancel student loan debt for as many borrowers as possible, no matter how many times Republican elected officials try to stand in his way.

Following the Supreme Court’s denial of Biden’s initial proposal last year, the president committed to exploring alternative avenues for providing relief from student loan debt. Since then, in order to create a new student loan forgiveness program, the Department of Education has been going through a formal and drawn-out procedure called negotiated rulemaking.

The Biden administration’s initial attempt at comprehensive loan forgiveness, which would have erased up to $20,000 in student loan debt for borrowers making $125,000 or less annually, employed a different procedure.

The new schemes cater to particular borrower demographics. If the plan is carried out as suggested, borrowers who fit any of the following descriptions may receive relief:

There will still be a public feedback period for the revised ideas that were announced on Monday. The Department of Education will then release the final version of the regulation following a review of those comments.

Generally, a final rule might go into effect on July 1, 2025, if it is published by November 1st following negotiated rulemaking.

It is possible to make some exceptions to the rule, and some sections of it may be applied early. For instance, some components of the income-driven student debt repayment plan known as the SAVE Plan were put into place by the Biden administration last year, while other components won’t go into force until July.

According to the White House, the Department of Education may begin to waive accrued interest for eligible borrowers in the fall as part of the new student debt forgiveness ideas.

Even though Biden’s sweeping student loan forgiveness got knocked down by the Supreme Court, his administration has still canceled more student loan debt than under any other president – mostly by using existing programs. Under his administration, qualifying for student loan debt forgiveness has been simpler for a number of borrowers, including teachers and other public sector employees, borrowers with disabilities, and those who were duped by for-profit colleges.

Under Biden, 4 million people have had a total of $146 billion in federal student debt forgiven.

Further details have been added to this story.

Conclusion

The Biden administration’s new proposal for student loan debt relief marks a significant step toward offering relief to millions of Americans burdened by student debt. With potential debt cancellation and forgiveness, this plan could reshape the landscape of student loan policies and provide much-needed financial relief. Stay tuned for further developments and the potential impact of this groundbreaking initiative on student borrowers nationwide.

Connect with us for the Latest, Current, and Breaking News news updates and videos from thefoxdaily.com. The most recent news in the United States, around the world , in business, opinion, technology, politics, and sports, follow Thefoxdaily on X, Facebook, and Instagram .