- Introduction: The Revolutionary Effect of ₹20,000 Per Month SIP

- What’s a Reasonable Return?

- The SIP Formula

- Growth Scenarios

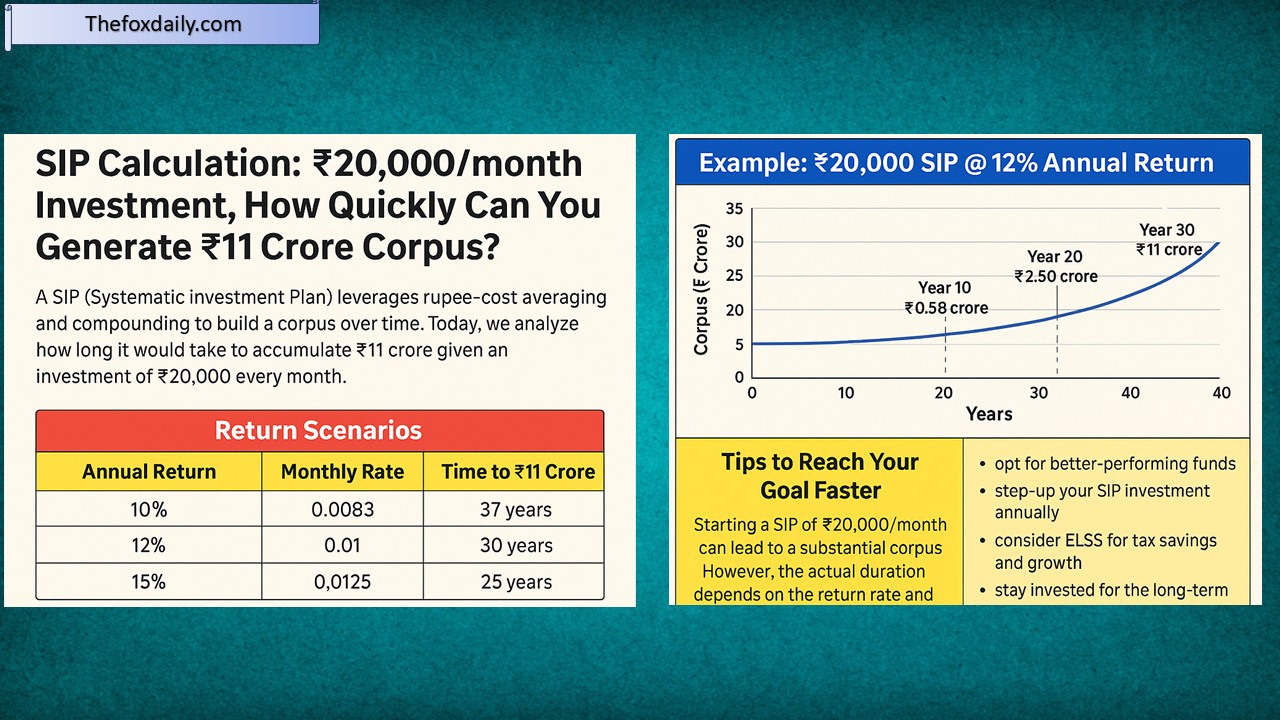

- Summary Table

- Real-World Example

- Ways to Reach ₹11 Crore Faster

- Visual Walk-through (12% Case)

- Tips to Stay Engaged

- Your Personalized SIP Plan

- Conclusion: ₹20K SIP to ₹11 Crore—The Power of Patience and Planning

Introduction: The Revolutionary Effect of ₹20,000 Per Month SIP

By utilising rupee-cost averaging and compounding—twopotent mechanisms that steadily build wealth—a disciplined Systematic Investment Plan (SIP) allows consistent investing over time.

The Big Question: How soon can you accumulate ₹11 crore if you invest ₹20,000 per month?

What’s a Reasonable Return?

Historically, Indian mutual funds, especially equity-based ones, have shown the following average annual returns:

-

Large-cap equity: 12–14%

-

Mid/small-cap or flexi funds: 15–20%

-

ELSS & diversified funds: 10–15%

We’ll model 3 return scenarios for our ₹11 crore goal:

-

Conservative: 10% annual return

-

Moderate: 12% annual return

-

Aggressive: 15% annual return

The SIP Formula

To calculate the future corpus (M):

-

P = ₹20,000

-

i = monthly rate = annual return ÷ 12

-

n = number of months

-

M = ₹11 crore

Growth Scenarios

Scenario 1: 10% Annual Return (i = 0.00833)

-

You’ll need ~37 years (~444 months) to reach ₹11crore.

Scenario 2: 12% Annual Return (i ≈ 0.01)

-

You’ll need ~30 years (~360 months) to hit the goal.

Scenario 3: 15% Annual Return (i ≈ 0.0125)

-

You’ll need only ~25 years (~300 months) to reach ₹11crore.

Summary Table

| Annual Return | Monthly Rate (i) | Time to ₹11 Cr | Years |

|---|---|---|---|

| 10% | 0.00833 | 444 months | 37 years |

| 12% | 0.01 | 360 months | 30 years |

| 15% | 0.0125 | 300 months | 25 years |

Real-World Example

At 12% annual return, a ₹20,000/month SIP takes approximately 30 years to accumulate ₹11 crore—confirmed by popular online SIP calculators like Groww, PolicyBazaar, and HDFC Bank.

Ways to Reach ₹11 Crore Faster

-

Choose better-performing funds: Flexi-/mid-/small-capfunds may yield 15–20%+.

-

Top-up SIPs annually: Boost SIP by 5–10% yearly.

-

Use ELSS funds: For tax savings and enforced discipline (10–15% returns).

-

Stay long-term: Ignore market noise and stay invested.

Visual Walk-through (12% Case)

-

Year 10: ₹24 lakh invested → Corpus ~₹58 lakh

-

Year 20: ₹48 lakh → Corpus ~₹2.5 crore

-

Year 30: ₹72 lakh → Corpus ~₹11 crore

-

Year 40: ₹96 lakh → Corpus ~₹30 crore+

Tips to Stay Engaged

-

Quarterly rebalancing to align risk

-

Stay calm during volatility to avoid panic decisions

-

Avoid frequent switching to reduce costs

-

Review yearly: Switch if fund underperforms the benchmark

Your Personalized SIP Plan

-

Moderate (12%): ₹11 crore in 30 years (start at age35 → retire with corpus at 65)

-

Aggressive (15%): ₹11 crore in 25 years (achieve at 60)

-

Conservative (10%): ₹11 crore in 37 years (around age 70)

Suggested Portfolio Split

-

₹10,000 in large-cap equity funds (12–14%)

-

₹6,000 in mid/small-cap or flexi funds (15–18%)

-

₹4,000 in ELSS (tax benefits + long-term growth)

Pro tip: Add 5–10% SIP top-up yearly and you may shaveoff2–5 years from your target timeline.

Conclusion: ₹20K SIP to ₹11 Crore—The Power of Patience and Planning

Building an ₹11 crore corpus from a ₹20,000/month SIP is not a pipedream. With consistency, smart decisions, and time on your side, it’s mathematically achievable. Whether your goal is financial independence, early retirement, or securing your family’s future, the key is tostart early and stay invested.

Here’s what we’ve learned:

-

At 10% returns: Goal achieved in ~37 years

-

At 12% returns: Takes ~30 years —realistic for most

-

At 15% returns: Just 25 years —ideal with high-performing funds

But remember—numbers don’t build wealth alone.Discipline, knowledge, and consistent action do.

By selecting a wise mutual fund mix (large-cap, flexi-cap, ELSS),topping up your SIP yearly, and holding steady during market fluctuations, you’ll accelerate your journey to financial freedom.

Haven’t started your SIP yet? Now is the best time. Even small steps build big wealth if you start today.

Use a SIP calculator, research top funds, and take your first steptoward₹11 crore.

Don’t wait. Let your money work smarter—one SIP at a time.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest Business on thefoxdaily.com.

COMMENTS 0