Despite years of engagement in a global chip war, China remains a vital operation base for several Asian-grown champions. But even from afar, Washington still holds key levers of power.

The most recent example is the US government’s decision to revoke permission for South Korean and Taiwanese chip giants to freely ship essential American technology-powered equipment to Chinese manufacturing facilities.

The modification, which will take effect the next year, may limit output and ultimately jeopardize the plants’ existence.

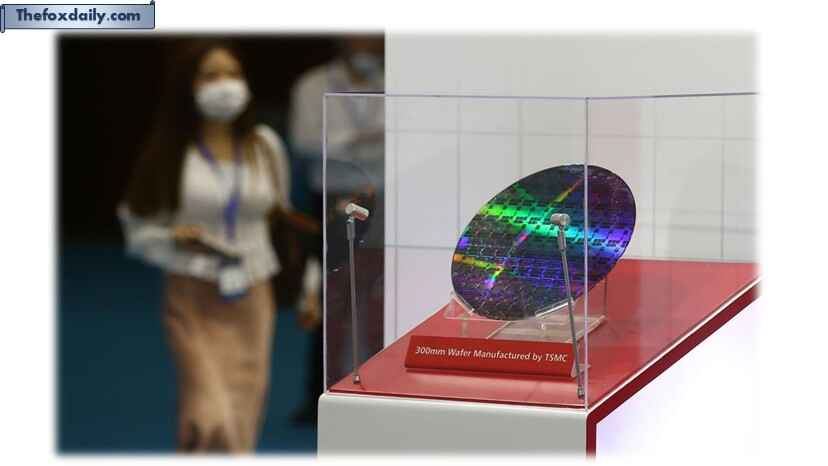

The Biden-era exemption let chipmakers TSMC, SK Hynix and Samsung export critical production equipment to China. Cutting that exemption underscores how important the US is to the global chip supply chain – and to all the products those chips help power, from cars to phones to weapon systems.

That’s because, even though TSMC and Samsung are major chip manufacturing leaders, the US still holds commanding positions in chip design and related software, exemplified by Nvidia’s dominance in AI Chips. Additionally, American firms like Applied Materials, Lam Research, and KLA provide vital chipmaking equipment that is used extensively by Taiwanese and South Korean businesses.

Washington’s action also emphasizes how difficult it is for these businesses to strike a balance as tensions between the two biggest economies in the world rise.

The Commerce Department said in a statement last week the policy change closed an export control “loophole.” The department added it intends to grant licenses to allow the firms to continue their operations in China but not to expand capacity or upgrade technology.

Analysts, however, worry if the licenses will be approved fast enough to avoid disrupting operations abroad.

In order to etch tens of billions of transistors—each 10,000 times thinner than the width of a human hair—onto a single microchip, a large array of machinery must be constantly adjusted, maintained, and updated. Chipmaking is a precision industry.

Applying for permits for each of these processes is a “cumbersome” process, according to Sanjeev Rana, head of Korea research at brokerage company CLSA. Delays might cause disruptions and raise the cost of memory chips, which are Chinese-made semiconductors used by Samsung and SK Hynix to let devices store data.

Due to their greater presence in China, the two Korean companies are more susceptible to the change. Samsung produces 30% of its NAND chips—one of the two types of memory chips that store data without the need for power—at its Chinese factory.

According to Bernstein statistics, the China plants of Samsung and SK Hynix together produce 10% of the world’s DRAM chips and 15% of its NAND chips.

According to Rana, these facilities’ competitiveness in China would gradually deteriorate, even if the businesses were able to obtain permits in time.

“I believe it will be challenging to continue producing memory chips in the long run with the current setup,” he stated. In reference to fabrication facilities, he continued, “I believe the US ultimately wants these companies to build memory fabs, or at least some capacity in the US.”

Washington’s tightening of the screws contrasts with President Donald Trump‘s seeming support for the wish of large American IT companies to relax restrictions on China. In recent months, Trump has allowed some Nvidia chip shipments to China and lifted restrictions on worldwide access to AI technology that were put in place under the Biden administration.

Since Trump’s first administration, the US has been working harder to limit China’s technological advancements. In 2022, the Biden administration implemented broad prohibitions on the sale of semiconductors and chipmaking equipment to America’s strategic adversary, with the exception of the China plants of the three chip giants.

As it keeps in regular contact with the Korean and American governments, SK Hynix said in a statement that it will take the required steps to lessen the impact of the present actions on its operations. Samsung declined to comment.

TFD has reached out to the Commerce Department’s office responsible for export controls for comment.

In comparison with SK Hynix and Samsung’s relatively high exposure, the loss of the authorization is expected to pose only limited impact to TSMC – the world’s largest contract chipmaker – which only makes a small number of its less advanced computing chips in China, experts said.

At least 80% of the Taiwanese chip giant’s production capacity will stay in Taiwan by 2030, despite the company’s aggressive intentions to expand internationally in the US, Japan, and Germany, according to market research firm TrendForce.

TSMC stated in a statement that it is assessing the matter and taking the necessary actions, such as speaking with the US government. “We remain fully committed to ensuring the uninterrupted operation of TSMC Nanjing,” it said.

The US action may cause uncertainty for TSMC’s activities in China, according to a statement from Taiwan’s Ministry of Economic Affairs. But given that the Nanjing facility only accounts for around 3% of the Taiwanese chipmaker’s total production capacity, it said the change will not affect the nation’s chip industry competitiveness.

An unintentional advantage for Chinese businesses

Over the past decade, China has worked to build a self-reliant semiconductor supply chain, a nationwide push made more urgent by Washington’s tightening of tech restrictions since Trump’s first term.

In the memory chips industry, which has long been dominated by Samsung, SK Hynix, and America’s Micron, China’s ChangXin Memory Technologies (CXMT) and Yantze Memory Technologies (YMTC) have become the leading competitors, at least in the nation for the time being.

However, experts warned that although the White House‘s action would further restrict China’s access to semiconductors created elsewhere, it might also help these Chinese companies.

According to Troy Stangarone, a non-resident fellow at the Carnegie Mellon Institute for Strategy and Technology, “the incapacity of Samsung and SK Hynix to upgrade equipment at their Chinese fabs will force them to continue ceding market share as these facilities become less competitive, even though they still lead their Chinese competitors in market share.”

Stangarone cautioned of further difficulties as well. Last month, Nvidia and AMD made a historic deal with Trump, agreeing to give the US government 15% of their chip sales profits to China in return for export licenses.

“Samsung and SK Hynix cannot preclude the possibility that this move is an initial step to seeking a share of revenue in return for the issuance of licenses needed to continue or upgrade their operations in China,” he said.

As with every US move to tighten tech curbs against China, Beijing has so far expressed opposition.

Without providing any additional information, a spokesman for the Commerce Ministry said on Saturday that Beijing will take the required steps to protect the interests of its businesses and urged the US to “correct its wrongdoing.”

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest Business on thefoxdaily.com.

COMMENTS 0