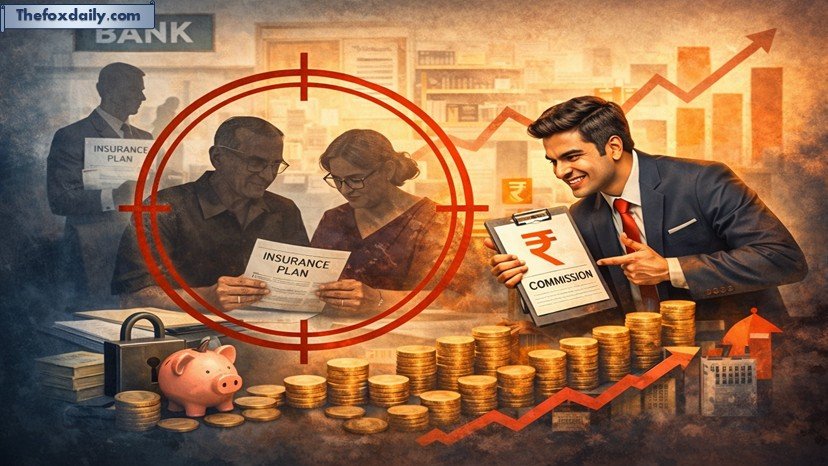

India’s insurance sector is at a defining moment. On one hand, the industry is witnessing strong growth driven by rising healthcare costs, evolving customer needs, GST rationalisation, and increasingly customised policy offerings. On the other, persistent gaps in product understanding and financial literacy continue to create fertile ground for insurance mis-selling — an issue that threatens long-term trust in the system.

Recent data from the Insurance Regulatory and Development Authority of India (IRDAI) Annual Report 2024–25 illustrates the scale of activity in the sector. Insurers processed more than 11.26 crore general and health insurance claims and 26.68 lakh life insurance claims during the year. However, alongside this high volume of claims, 2,57,790 policyholder complaints were registered on the Bima Bharosa portal across health, life, and general insurance categories.

This contrast is revealing. While claims settlements remain substantial, disputes frequently arise not from deliberate misconduct alone, but from misunderstandings around product features, exclusions, waiting periods, and coverage limitations. In many cases, the gap lies between what customers believe they purchased and what the policy actually provides.

The Rising Cost of Mis-Selling

Insurance mis-selling carries consequences far beyond individual dissatisfaction. It weakens confidence in insurers, strains grievance redressal systems, and disrupts the broader risk pool. According to regulatory observations, complaints related to Unfair Business Practices (UFBP), including mis-selling, rose to 26,667 in FY2024–25. These accounted for more than 22% of life insurance complaints — an increase from 19% the previous year.

When unsuitable policies lead to claim rejections, the impact cascades. Customers lose faith, first-time buyers withdraw from the market, and overall costs increase as disputes mount. Risk pools become distorted, administrative expenses rise, and ultimately premiums may climb for everyone.

Notably, first-time buyers are disproportionately affected. Many rely heavily on agent recommendations or online suggestions at the point of sale. Without adequate understanding, they are more vulnerable to purchasing policies that do not align with their health profile, income stability, or long-term financial goals.

Technology as a Tool for Transparency

The industry is increasingly responding with technology-led solutions. Artificial Intelligence (AI), digital underwriting, and generative AI Tools are now being integrated across sales, servicing, and claims management functions. These innovations are not merely operational upgrades — they are becoming instruments of consumer protection.

Industry estimates suggest that AI-driven systems are improving claims payout accuracy, reducing service costs by 20–30%, and enhancing underwriting efficiency by 10–20%. By embedding intelligence into comparison engines and advisory tools, insurers and insurtech platforms are shifting the focus from aggressive sales targets to product suitability.

India’s insurtech ecosystem, currently valued at over USD 15.8 billion and generating nearly USD 0.9 billion in annual revenue, reflects this structural transition. Digital platforms now help consumers compare premiums in context, evaluate exclusions, identify sub-limits, and understand co-payment clauses before committing to a purchase.

Importantly, pricing parity across digital platforms is also reducing arbitrage-driven mis-selling. When premiums are standardised and product disclosures are clearer, the emphasis naturally shifts toward informed comparison rather than persuasion-based selling.

Why Awareness Is the First Line of Defence

However, corrective action and technological upgrades alone are not enough. Preventing insurance mis-selling requires a deeper, structural change in how insurance is understood, evaluated, and selected.

Consumer awareness must become the foundation of the system. Awareness does not simply mean comparing prices. It involves understanding exclusions, waiting periods, disease-specific caps, co-payments, deductibles, and policy renewal conditions. It requires buyers to assess whether a product matches their risk exposure and financial capacity.

When policyholders understand their risk profile — whether related to health, life stage, income protection, or asset coverage — they are less likely to accept unsuitable recommendations. They are also more confident in asking critical questions and demanding clarity from agents or digital platforms.

Insurance, by design, is not a one-size-fits-all product. Customisation is possible and increasingly accessible. Yet customisation only delivers value when customers clearly understand what they are buying and why.

Shifting the Focus: From Purchase to Protection

As insurers and insurtech firms integrate intelligence across the value chain, the focus must shift from completing transactions to enabling informed decisions. Selecting the cheapest premium should never be the sole objective. A policy that appears affordable upfront may result in significant financial strain later due to coverage gaps or restrictive clauses.

Clarity is the cornerstone of awareness. When customers understand policy structures, add-ons, claim procedures, and long-term implications, insurance becomes a protective instrument rather than a disputed contract.

Well-informed purchasing decisions reduce grievance volumes, lower systemic friction, and strengthen long-term trust between insurers and policyholders. The benefits extend across the ecosystem — from individual households to regulators and risk managers.

A Shared Responsibility for a Stronger Insurance Ecosystem

Ultimately, safeguarding consumers from insurance mis-selling is not the responsibility of one stakeholder alone. Insurers must simplify product design and communication. Digital platforms must provide unbiased, transparent guidance. Regulators must enforce clarity and accountability. Most importantly, customers must engage with curiosity, caution, and awareness.

As India’s insurance penetration continues to expand, raising awareness is not merely a consumer advantage — it is a systemic necessity. Selecting insurance thoughtfully, rather than hurriedly, transforms it from a one-time financial transaction into a durable safety net.

In the long run, awareness is the strongest defence against mis-selling and the foundation of a resilient, trustworthy insurance ecosystem in India.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest Personal Finance on thefoxdaily.com.

COMMENTS 0