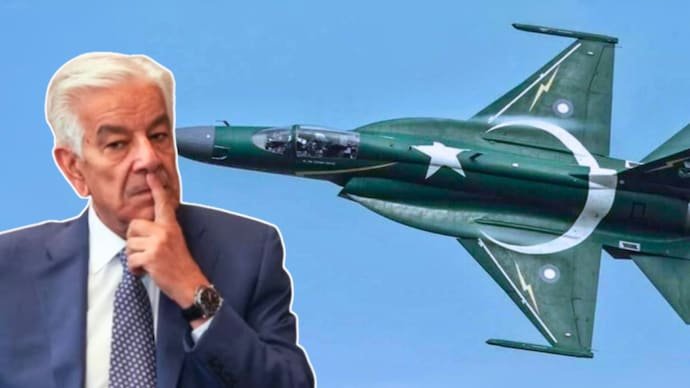

Pakistan’s Defence Minister Khwaja Asif has once again made a bold claim—this time suggesting that the country may be able to free itself from dependence on the International Monetary Fund (IMF) within six months due to a surge in fighter jet orders following the brief military confrontation with India in May 2025.

Speaking to Karachi-based GeoTV, Asif asserted that Pakistan’s military performance during the four-day “mini-war” with India had impressed the global defence market, leading to a spike in orders for its fighter aircraft. “Our aircraft have been tested, and we are receiving so many orders that Pakistan may not need the IMF in six months,” he claimed.

The statement came at a time when Pakistan, under IMF pressure, was forced to privatize its national carrier, Pakistan International Airlines (PIA), as part of stringent fiscal reforms. Given the country’s precarious economic condition, analysts say Asif’s remarks appear detached from financial reality.

Reality Check: Pakistan’s Limited Role in Fighter Jet Production

While Pakistan does export fighter aircraft such as the JF-17 Thunder and operates Chinese-origin J-10 jets, experts point out that Islamabad’s actual share in production and profits is limited. The JF-17 Thunder is a joint venture with china, and Pakistan reportedly manufactures only about 35% of the aircraft’s airframe.

Political scientist and defence analyst Ayesha Siddiqa dismissed Asif’s claims, stating that the defence minister “sounds like journalists who claim to cover defence but cannot tell the back of a plane from its front.” She noted that Pakistan’s limited manufacturing stake means it earns only a fraction of the revenue from each jet sale.

In addition to Pakistan, the JF-17 incorporates components sourced from multiple countries, including China, Italy, Turkey, Russia, and the United Kingdom. The aircraft is powered by the Russian-made Klimov RD-93 turbofan engine, further diluting Pakistan’s share of profits.

Even if a JF-17 sells for around $15 million or a J-10 for approximately $40 million, analysts argue that Pakistan’s net earnings per aircraft are minimal once revenue-sharing with China and foreign suppliers is factored in.

Debt Mountain vs Jet Sales: The Numbers Don’t Add Up

Pakistan’s total national debt and obligations are estimated to exceed $280–300 billion as of early 2026. Against this backdrop, even optimistic fighter jet exports would barely register as a dent in the country’s massive liabilities.

According to official figures, Pakistan’s external debt alone stands at around PKR 26 trillion. Servicing this debt consumed nearly PKR 8.9 trillion in FY25—more than half of the federal government’s total revenues, as reported by Karachi-based Dawn in September 2025.

“How much of the jet sale revenue actually reaches Pakistan?” economists ask. “Even under ideal assumptions, it is mathematically impossible for fighter aircraft exports to offset Pakistan’s debt burden or replace IMF financing.”

Claims Linked to Conflict Performance Also Disputed

Asif’s assertion that global demand surged due to Pakistan’s military performance during the India conflict is also widely contested. Independent assessments indicate that Pakistan Air Force (PAF) suffered significant losses during India’s limited Operation Sindoor.

Reports suggest that between four and nine Pakistani fighter jets were lost, including aircraft destroyed on the ground at key air bases such as Bholari and Nur Khan during BrahMos missile strikes. Over 20% of PAF infrastructure across 11 air bases reportedly sustained damage, with hangars destroyed and runways cratered.

Critical assets, including Saab 2000 AWACS platforms, TPS-43J radar systems, and key communication networks, were reportedly neutralized, severely degrading Pakistan’s aerial surveillance and command capabilities. These setbacks, along with troop casualties, are believed to have contributed to Pakistan seeking a ceasefire.

IMF Pressure and the Sale of Pakistan International Airlines

Contrary to Asif’s optimism, Pakistan recently sold Pakistan International Airlines in December as part of IMF-mandated asset divestment and fiscal discipline measures. The airline was privatized for PKR 13,500 crore (approximately Rs 4,300 crore), underscoring the severity of Pakistan’s financial stress.

Analysts argue that a country forced to sell its national airline weeks ago is unlikely to achieve financial independence through defence exports alone in the near future.

“Economy on a Ventilator,” Say Pakistani Economists

Pakistani economists have repeatedly warned that the country’s economy remains in a fragile state. Economist Qaiser Bengali, speaking in November 2025, bluntly stated that Pakistan had “already defaulted,” explaining that reliance on new loans to repay old ones constitutes a de facto default.

Bengali warned that Pakistan’s economy is “on a ventilator of debt” and could collapse if key lenders such as China or Saudi Arabia refuse rollovers or fresh financing. “The day we try to act independently, even this ventilator will stop working,” he cautioned.

In light of these realities, Khwaja Asif’s claim that Pakistan could dispense with IMF support within six months appears less like an economic forecast and more like political rhetoric disconnected from ground realities.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest World on thefoxdaily.com.

COMMENTS 0