A hard-hitting report by the European Court of Auditors (ECA) has laid bare the European Union’s dangerous dependence on imported critical raw materials, warning that the bloc’s ambitious renewable energy and climate targets for 2030 may be impossible to achieve without urgent and decisive action.

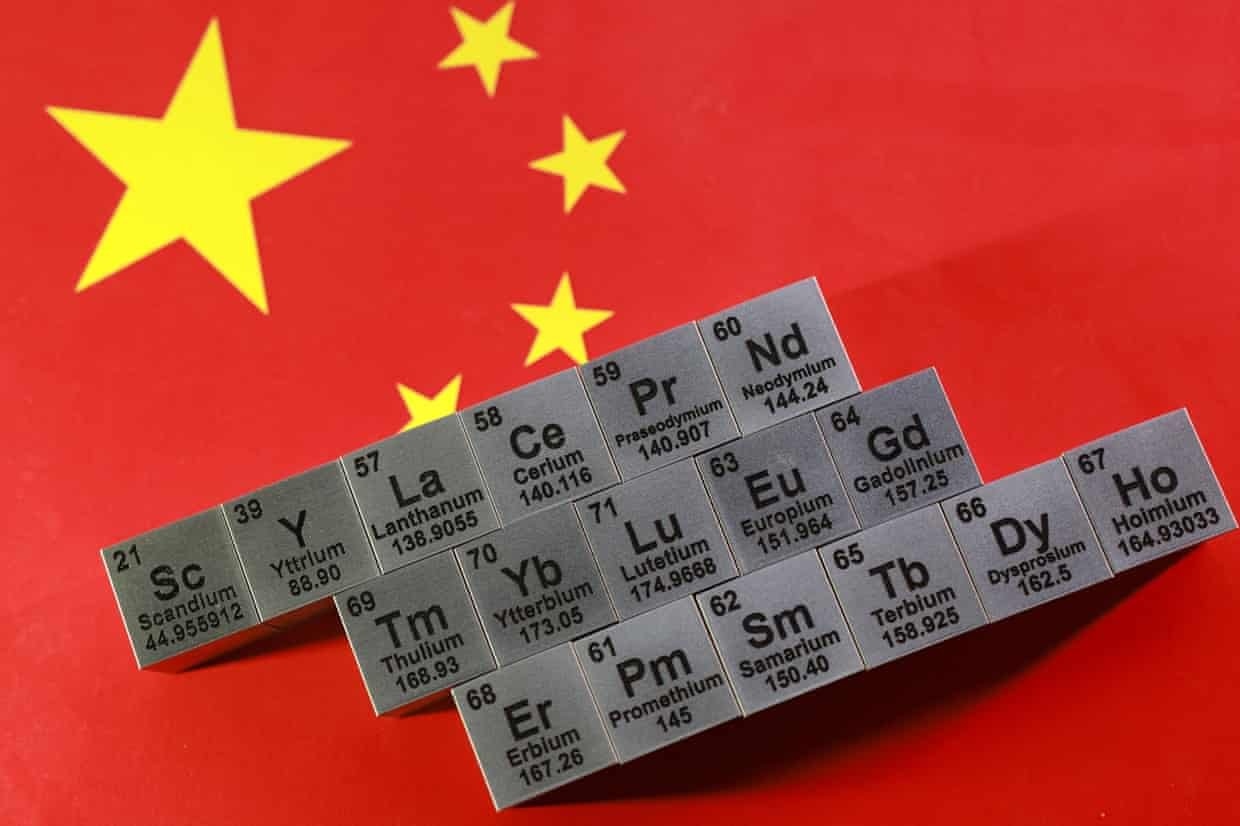

The EU currently relies heavily on China and several countries in the global south for the supply of critical minerals and rare earth elements—materials that are indispensable for modern technologies ranging from smartphones and electric vehicles to wind turbines, solar panels, and advanced military aircraft.

In a damning assessment released in Luxembourg, the ECA concluded that the EU’s target of sourcing 42.5% of its energy from renewables by 2030 is effectively “out of reach” under current conditions. The auditors highlighted persistent weaknesses in domestic mining, refining, and recycling capacity as key barriers to achieving strategic autonomy.

“It is therefore vital for the EU to up its game and reduce its vulnerability in this area,” said Keit Pentus-Rosimannus, the ECA member responsible for the audit, underscoring the urgency of reform.

The report reveals a stark gap between political ambition and industrial reality. While EU leaders frequently emphasize green transition and energy independence, the auditors argue that structural shortcomings continue to undermine these goals.

One of the most striking findings notes that mining and exploration activities within the EU remain “underdeveloped.” Even when new mineral deposits are identified, regulatory hurdles and lengthy approval processes mean it can take up to 20 years for a mining project to become operational.

“This makes any concrete contribution by the 2030 deadline hard to imagine,” the report states, highlighting how delays threaten the credibility of EU climate commitments.

Against this backdrop, global competition for critical minerals is intensifying. During talks in Tokyo on Saturday, UK Prime Minister Keir Starmer agreed with Japanese counterpart Sanae Takaichi to fast-track cooperation on securing vital mineral supplies.

Similarly, US Secretary of State Marco Rubio convened a high-level meeting of around 20 nations in Washington on Wednesday. The discussions focused on coordinating the diversification of mineral supply chains for lithium, nickel, cobalt, copper, and rare earth elements—key components for electric vehicles, renewable energy infrastructure, and battery storage systems.

The Washington summit is widely seen as an effort to repair strained transatlantic ties and lay the groundwork for new strategic alliances aimed at reducing dependency on China.

Supply chain mapping included in the audit reveals a heavy reliance on eastern suppliers, particularly China and Russia. Together, they account for 29% of the nickel used across the EU’s automotive and aerospace sectors.

The EU is especially dependent on China for seven of the 26 critical minerals assessed in the report. These include 97% of magnesium used in hydrogen production, 71% of gallium essential for smartphones and satellite communications, and 31% of tungsten used in drilling and mining applications.

China’s dominance is even more pronounced in the rare earth sector. According to the ECA, Beijing controls between 69% and 74% of six key rare earth elements, including neodymium and praseodymium. These minerals are vital for manufacturing permanent magnets used in electric motors, wind turbines, car locking systems, and household appliances.

Official figures show that of the 20,000 tonnes of permanent magnets consumed by EU industry in 2024, approximately 17,000 tonnes were sourced from China, underscoring the scale of the dependency.

The audit also highlights vulnerabilities beyond China. Turkey supplies 99% of the boron used in EU solar panel manufacturing, while Chile remains the dominant supplier of lithium, a cornerstone material for electric vehicle batteries.

The ECA warned that the EU risks becoming trapped in a “vicious circle”, where insufficient domestic capacity undermines investment, and weak investment further delays capacity-building. As a result, many strategic projects may struggle to secure reliable supplies of critical raw materials by 2030.

“Critical raw materials are essential for the energy transition, competitiveness, and strategic autonomy,” Pentus-Rosimannus said. “Unfortunately, we are now dangerously dependent on a handful of nations outside the EU for their supply.”

The findings come amid growing concern within Brussels. EU Industry Commissioner Stéphane Séjourné recently warned that Europe risks becoming “just a playground for its competitors” unless it adopts a more ambitious, effective, and pragmatic industrial policy.

The auditors also concluded that efforts to diversify imports have so far failed to deliver tangible results. Partnerships established with seven countries suffering from weak governance actually resulted in declining supplies between 2020 and 2024.

Alarmingly, ten of the 26 critical minerals examined are entirely imported, and the EU currently does not mine any of the 17 rare earth metals it considers essential. Recycling efforts also remain inadequate, with only 16 key raw materials being recycled within the bloc.

The report serves as a stark warning: without urgent reforms in mining policy, faster permitting, stronger recycling systems, and deeper international cooperation, the EU’s green transition risks being built on an increasingly fragile foundation.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest World on thefoxdaily.com.

COMMENTS 0