The so-called “mother of all trade deals” between India and the European Union is not just reshaping global trade dynamics—it is also sending shockwaves across the border into Pakistan. While the agreement has been hailed as a landmark economic breakthrough for New Delhi, it has exposed deep structural weaknesses in Pakistan’s export strategy and intensified fears in Islamabad of losing its most valuable overseas market.

After nearly two decades of negotiations, the India–EU Free Trade Agreement is expected to grant India preferential access to sectors that have traditionally underpinned Pakistan’s export success in Europe, particularly textiles and clothing. These labor-intensive industries had already been under strain after former US President Donald Trump imposed steep tariffs on Indian goods. With the EU now opening its doors wider to India, Pakistan finds itself under unprecedented competitive pressure.

The sense of alarm in Islamabad is palpable. The European Union is Pakistan’s second-largest export destination, accounting for nearly $9 billion (approximately Rs 8.25 lakh crore) in annual exports—most of it textiles and garments. Any erosion of this market could have devastating consequences for Pakistan’s fragile economy.

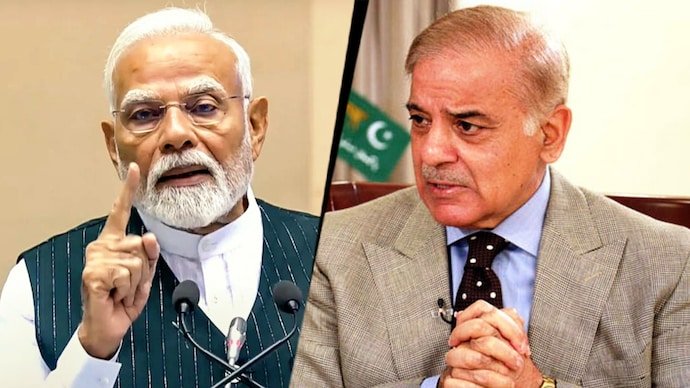

In response, Pakistan’s Foreign Office confirmed that it is actively engaging with EU member states as well as officials in Brussels to assess the fallout from the India–EU deal. Deputy Prime Minister and Foreign Minister Ishaq Dar convened an emergency inter-ministerial meeting, while Prime Minister Shehbaz Sharif personally met the EU’s envoy in Islamabad to discuss potential safeguards.

“We are following this matter bilaterally with EU member states and also collectively with the EU headquarters in Brussels,” a spokesperson for Pakistan’s Foreign Office said, underscoring the urgency of the situation.

Why Is Pakistan Feeling the Heat?

The timing of the India–EU FTA could not be worse for Pakistan. The country’s economy remains under severe stress, with dwindling foreign exchange reserves and limited export diversification. According to World Bank estimates, Pakistan’s exports have declined sharply—from around 16% of GDP in the 1990s to just about 10% in 2024.

Pakistan’s primary concern is that India’s preferential access to the EU market will erode its competitiveness. For years, Pakistan has benefited from the EU’s Generalised System of Preferences Plus (GSP+), which allows duty-free access for nearly two-thirds of its exports. This arrangement has been the backbone of Pakistan’s textile boom in Europe.

After Pakistan was granted GSP+ status in 2014, its textile exports to the EU surged by an astonishing 108%. Today, nearly $7 billion—around 40% of Pakistan’s total textile exports—are destined for the 27-member European bloc. However, this advantage is under serious threat, as Pakistan’s GSP+ status is due to expire next year, with no clear indication from Brussels about an extension.

The textile sector is Pakistan’s largest industrial employer, supporting between 15 and 25 million jobs directly and indirectly. Any loss of EU market share would therefore have severe social and political consequences.

What Does the India–EU Deal Mean for India?

Before the FTA, Indian textiles and apparel exports to the EU faced tariffs of up to 12%. Under the new agreement, the EU will eliminate or significantly reduce tariffs on 99% of goods imported from India over a seven-year period. In return, India will cut duties on about 97% of EU imports.

This tariff liberalisation gives Indian exporters a decisive edge in labor-intensive sectors such as garments, footwear, jewellery, and leather goods—areas that were hit hard by US trade restrictions in recent years. Pakistan’s long-held advantage of duty-free access is effectively neutralised.

Bangladesh, another major garment exporter to Europe, also faces stiffer competition. While it currently enjoys duty-free access as a Least Developed Country (LDC), India’s scale, supply-chain depth, and now tariff parity could reshape sourcing decisions across Europe.

Union Commerce Minister Piyush Goyal highlighted this imbalance while announcing the deal on January 27. “For years, we asked why Bangladesh could export $30 billion worth of goods to the EU while India could not. The reason was structural trade barriers, which this agreement now removes,” he said.

Pakistan’s Economic Reckoning

The consequences for Pakistan could be profound. From the moment the India–EU FTA comes into force, Indian textiles and apparel will enter Europe with zero or near-zero tariffs, fundamentally altering price competitiveness.

“India has become far more competitive in the EU market, effectively neutralising—and in some segments surpassing—Pakistan’s GSP+ advantage,” Kamran Arshad, chairman of the All Pakistan Textile Mills Association (APTMA), told Dawn.

Compounding Pakistan’s woes is the EU’s broader strategic recalibration. Brussels is actively seeking diversified trade partnerships to reduce dependence on an assertive china and an increasingly unpredictable United States. In that context, the EU has not committed to extending Pakistan’s GSP+ status beyond its expiry.

Former Pakistani Commerce Minister Dr. Gohar Ejaz issued a stark warning to the Sharif government, calling the India–EU deal the end of Islamabad’s “zero-tariff honeymoon” with Europe. He cautioned that up to 10 million jobs could be at risk if urgent reforms are not undertaken.

“At regional energy, tax, and financing costs, Pakistan must allow industry to compete,” Ejaz said, pointing to systemic inefficiencies that continue to burden exporters.

Exporters have echoed these concerns, warning that without immediate relief—especially lower energy prices—Pakistan could rapidly lose market share in Europe. In response, the government announced a reduction of Rs 4.04 per unit in electricity tariffs for industrial consumers, a move aimed at easing production costs.

Yet analysts argue that such short-term measures may not be enough. Without deep structural reforms, export diversification, and sustained competitiveness, Pakistan’s trade model remains vulnerable.

In the final analysis, what has been hailed in New Delhi as the “mother of all trade deals” has undeniably become the mother of all setbacks for Pakistan—exposing the cost of missed reforms and overdependence on preferential access in a rapidly changing global trade order.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest World on thefoxdaily.com.

COMMENTS 0