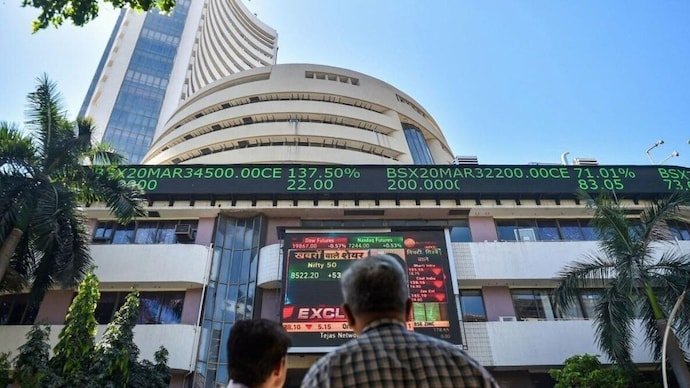

Despite encouraging developments around the long-pending India-European Union (EU) trade agreement, Indian equity markets opened on a weak note on Tuesday. Investors appeared hesitant, choosing caution over optimism even as reports suggested that both sides were close to sealing a landmark deal later in the day.

Following the Republic Day holiday, Dalal Street reopened but failed to shake off the prevailing bearish undertone. Instead of a positive start, benchmark indices extended their recent downward trend, reflecting broader concerns among market participants.

In early trade, the Nifty 50 declined close to 100 points, while the BSE Sensex tumbled more than 400 points. Although selective buying helped both indices recover some ground by around 9:40 am, the rebound lacked conviction. Market experts noted that sentiment continued to remain fragile.

The initial decline coincided with reports that India and the European Union had finally reached broad consensus on a major trade agreement after years of prolonged negotiations. Both sides described the agreement as significant, particularly at a time when global trade relations remain under strain. The formal announcement is expected later today.

Why Did Markets Fall Despite the India-EU Trade Deal Optimism?

Contrary to expectations, the positive trade news failed to lift markets as auto stocks emerged as the biggest drag. Reports suggesting that India may reduce import duties on European automobiles as part of the trade pact sparked sharp selling pressure across domestic auto counters.

According to a Reuters report, New Delhi is considering cutting import duties on European cars to around 40%. If implemented, this would open up India’s fiercely competitive automobile market to increased foreign competition. Investors reacted swiftly, factoring in the potential impact on domestic manufacturers’ margins and market share.

Mahindra & Mahindra was among the worst performers, plunging nearly 4% in early trade. The Nifty Auto index dropped as much as 2% during the morning session, with widespread losses across major auto stocks pulling the broader market lower.

Beyond the auto sector, sentiment was further dampened by continued foreign institutional investor (FII) selling. Market participants pointed out that persistent outflows by overseas investors have been weighing heavily on Indian equities over the past few weeks.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, highlighted that sustained foreign selling remains one of the key reasons behind the market’s weakness. According to him, foreign institutional investors sold shares worth nearly ₹40,000 crore in January alone.

Bathini added that as long as this trend of selling continues, markets are likely to remain under pressure. He also advised investors to closely track the critical Nifty 25,000 level. Holding above this level could lead to a short-term bounce, while a decisive break below it may trigger further downside in the near term.

Commodity Markets Steal the Spotlight

While equity markets struggled, commodity markets surged sharply, highlighting a shift towards safe-haven assets. Silver futures jumped nearly 6% to hit a fresh record high of ₹354,780 per kilogram. Meanwhile, Indian Gold futures climbed over 1.7% to touch an all-time high of ₹159,820 per 10 grams.

Silver has emerged as one of the best-performing assets this year, gaining over 50% so far. Gold prices have also remained firm as investors continue to seek safety amid global economic uncertainty and geopolitical tensions.

In international markets, gold prices advanced further after crossing the $5,100 mark in the previous session. Ongoing global tensions and concerns over economic stability have kept demand for safe-haven assets elevated. Silver prices overseas also hovered close to record highs.

The overall market reaction suggests that while the India-EU trade agreement holds long-term promise, short-term concerns continue to dominate investor behaviour. Fears around tariff reductions, aggressive foreign selling, and key technical levels are currently outweighing positive macro developments.

As markets digest further details from the trade pact announcement and monitor global cues, volatility is expected to remain high through the session. For now, Dalal Street remains cautious, choosing prudence over optimism despite the encouraging trade headlines.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest Business on thefoxdaily.com.

COMMENTS 0