Owning a home is a cornerstone of the American dream – a symbol of hard work and stability. However, passing that home to the next generation can be more complicated than most people expect. According to financial experts, a lack of estate planning often results in family conflict and unexpected tax or maintenance burdens.

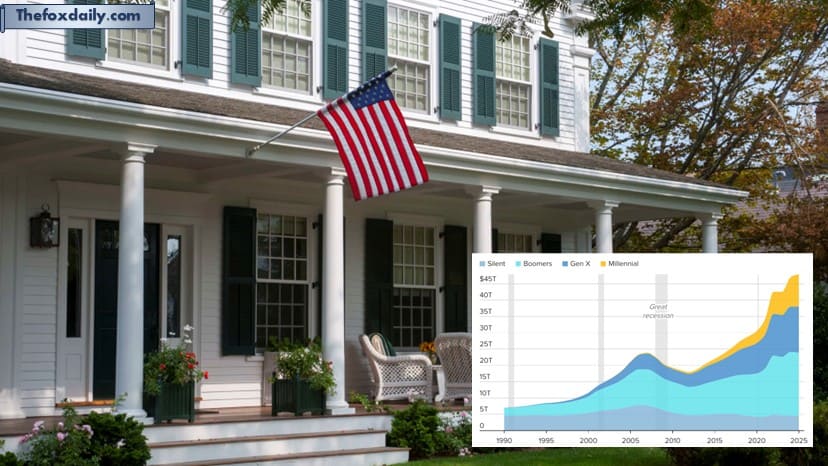

Federal Reserve data reveals that Baby Boomers and the Silent Generation collectively own more than $25 trillion in real estate assets. While real estate represents a significant share of the $105 trillion expected to be inherited by 2048, it also poses unique transfer challenges that cash or investment assets do not.

The Emotional and Financial Weight of Real Estate

“Homes hold a lot of memories, and parents want their children to continue making memories there,” says Jackie Garrod, Regional Wealth Manager at Northern Trust. “But this emotional attachment makes planning even more crucial – parents need to talk to their children early and understand their concerns.”

Without clear instructions, experts warn, a cherished family home can become a source of anxiety and disagreement instead of love and legacy.

Common Challenges When Passing Down Real Estate

Experts identify several key issues that frequently arise when multiple heirs inherit a single property:

- Maintenance: Who is responsible for repairs, painting, and renovations?

- Usage: When and how will family members use the home?

- Decision-making: How will major disagreements be resolved?

- Expenses: Who covers taxes, insurance, utilities, and upkeep?

- Exit strategy: What happens if one heir wants to sell, move away, or cannot afford the costs?

Mark Parthemer, Chief Financial Strategist and Florida Regional Director at Glenmede, warns that an unclear plan can turn a family’s dream home into “a nightmare full of stress and resentment.”

Survey Highlights Financial Concerns Among Younger Heirs

A recent LegalZoom survey of 2,000 Americans found that 62% of older adults plan to leave real estate to their children. However, 42% of younger Americans said they would not feel financially ready to manage or maintain an inherited property. Their top concerns included:

- Property taxes and maintenance costs (20% each)

- Legal responsibilities (11%)

- Outstanding debt on the property (12%)

Experts Recommend Planning Early – and Talking Often

While liquid assets such as cash or brokerage accounts are easier to divide, some parents remain emotionally committed to passing down their home. In such cases, experts advise starting with a candid family discussion.

“Parents should create a user agreement that defines maintenance duties, expense sharing, and usage schedules,” says Garrod. “It helps prevent misunderstandings and keeps everyone on the same page.”

Parthemer adds that open, intergenerational communication is key: “Teaching the next generation about how the plan works ensures its success – that’s how families preserve wealth beyond three generations.”

Estate Planning Options: LLCs and Trusts

Experts suggest two main structures to simplify property transfers and avoid probate: forming a Limited Liability Company (LLC) or setting up a trust.

Using an LLC for Property Transfer

Garrod notes that an LLC offers liability protection. For instance, if someone is injured on the property, personal assets remain safe from lawsuits. Families can also create an operating agreement outlining management responsibilities, ownership shares, income distribution, and procedures if a family member exits the LLC.

Combining an LLC with a trust adds another layer of protection – shielding the property from divorce settlements or estate disputes.

Using a Trust for Property Protection

Both revocable and irrevocable trusts can safeguard assets and avoid lengthy court processes. A trust can also clarify responsibilities, such as who maintains the property, how expenses are handled, and how heirs may eventually sell or pass on their shares.

The Bottom Line

Passing down real estate is about more than just ownership – it’s about preserving family values, financial security, and peace of mind. The sooner families discuss and document their intentions, the smoother the transition will be.

Article source: Adapted and edited for SEO and readability. Originally reported by Medora Lee, USA TODAY, specializing in money, Markets, and personal finance.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest Personal Finance on thefoxdaily.com.

COMMENTS 0