Venezuela possesses the largest proven oil reserves on the planet—an extraordinary fact that alone explains the intense strategic interest of former US President Donald Trump in the South American nation. Trump has previously claimed that Venezuela would come under American control following decisive military action against its leadership. Yet the most striking contradiction remains: despite its vast oil wealth, Venezuela produces only about one million barrels of oil per day, accounting for roughly 0.8% of global crude output. This paradox lies at the heart of what many analysts describe as Trump’s “big oil gamble.”

According to reports, a US military operation—codenamed Operation Absolute Resolve—involved Airstrikes that reportedly killed more than forty people, followed by the arrest of Venezuelan President Nicolás Maduro and his wife on January 3 inside a heavily guarded military complex in Caracas. While Washington officially cited long-standing narcotics trafficking charges as justification, geopolitical experts widely believe that Venezuela’s oil reserves were a central motivator behind the intervention.

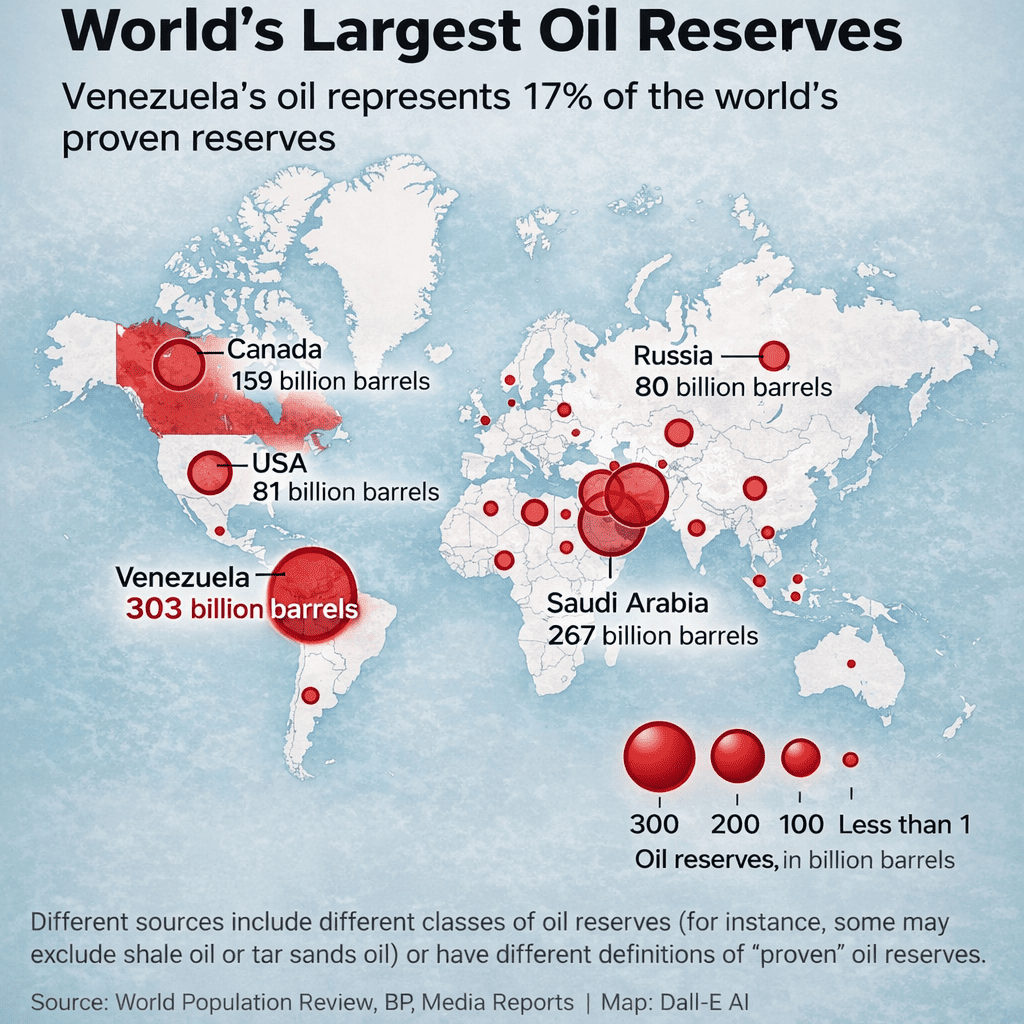

Venezuela’s oil endowment surpasses even Saudi Arabia’s, with an estimated 303 billion barrels of proven reserves—nearly one-fifth of the global total. Yet production remains drastically low. Decades of political mismanagement, entrenched corruption, chronic underinvestment, US sanctions, and the technical challenges of extracting extra-heavy crude have collectively crippled output. The result is a nation sitting atop immense energy wealth but unable to monetize it.

Following Maduro’s arrest, Donald Trump openly stated his intention to bring Venezuela’s oil sector under American influence. He claimed that US energy companies would invest billions of dollars to rehabilitate the shattered industry and potentially redirect Venezuelan crude to American refineries. This strategy aligns with Washington’s long-standing interest in Venezuelan energy, particularly after sweeping sanctions were imposed on Caracas in 2019.

According to estimates cited by Reuters, Washington believes that raising Venezuelan crude production to around two million barrels per day by 2030 could reduce global oil prices by as much as $4 per barrel. Such a shift would have significant implications for global energy markets, inflation, and geopolitical power balances.

The central question, however, remains unresolved: why is there such a dramatic gap between Venezuela’s oil reserves and its production? And can a US-backed revival realistically bridge that gap? Unlocking Venezuela’s oil potential is not just a political decision—it is a technical, financial, and institutional challenge of historic proportions.

How Venezuela’s Oil Production Collapsed After the 1990s

Data from global economic platform Trading Economics shows that Venezuela’s oil output peaked at around 3.5 million barrels per day in the late 1990s. By October 2025, production had plunged to approximately 956,000 barrels per day, before inching up slightly to 1.142 million barrels per day in November. This collapse fueled Venezuela’s broader economic breakdown, marked by hyperinflation, institutional failure, and one of the largest migration crises in modern history.

Most of Venezuela’s oil lies in the Orinoco Belt, home to massive reserves of extra-heavy crude. This oil is exceptionally viscous and difficult to extract, requiring specialized drilling techniques, advanced refineries, and costly imported diluents. Without sustained investment and technical expertise, much of this oil remains effectively trapped underground.

The Long Decline of Venezuela’s Energy Sector

The deterioration of Venezuela’s oil industry began under former president Hugo Chávez, Nicolás Maduro’s political mentor. In 2002, Chávez dismissed nearly 18,000 skilled workers following a strike at the state-run oil company PDVSA. The loss of technical expertise proved devastating.

In 2007, the Chávez government pushed out foreign energy companies through widespread nationalization. A Forbes analysis later noted that politically loyal appointees replaced professional managers, eroding operational efficiency. Revenues that could have modernized infrastructure were diverted to social programs, while refineries fell into disrepair and drilling rigs rusted. At one point, Venezuelan refineries were operating at barely 20% capacity.

Conditions worsened under Maduro. Debt defaults frightened investors, and production fell by nearly half. According to the Council on Foreign Relations, PDVSA was effectively cut off from international financial markets, accelerating the sector’s decline.

US Sanctions, Corruption, and Mismanagement Deepen the Crisis

US sanctions imposed in 2019 barred American companies from doing business with PDVSA, depriving Venezuela of access to markets, technology, and critical diluents needed for heavy crude processing. The situation deteriorated further after additional restrictions were introduced in 2024 following a disputed election.

To bypass sanctions, Venezuela increasingly relied on shadow tanker fleets and discounted oil sales to china and Iran. However, the US Treasury Department has stated that corruption, inefficiency, and steep discounts significantly reduced revenues, limiting any meaningful recovery.

With Maduro removed and Trump signaling a green light for US firms to re-enter Venezuela, attention has shifted to timelines and feasibility. Can a country holding nearly 20% of the world’s proven oil reserves realistically revive production—and at what cost?

Reviving Venezuela’s Oil Industry Is a Long and Costly Task

According to experts cited by the UK-based The Guardian, restoring Venezuela’s oil output to around three million barrels per day could take 10 to 20 years and require investments of $50–100 billion. The challenge extends beyond drilling—it involves rebuilding infrastructure, restoring skilled labor, overhauling legal frameworks, and restructuring massive debt.

Analysts suggest that if sanctions are lifted and US companies assume operational control, production could rise to 1.5 million barrels per day within two to three years. However, sustained recovery would depend on long-term political stability, regulatory certainty, and investor confidence.

Trump has claimed that American energy companies are ready to invest billions upfront, recovering costs through future oil sales. Yet major firms such as ExxonMobil, Chevron, and ConocoPhillips have not publicly confirmed any binding commitments, according to The Guardian.

Geopolitical analyst Jorge León told the publication, “My suspicion is that if President Trump said this publicly, there was probably already some understanding with US companies.” Still, uncertainty remains.

A Reuters analysis notes that with global oil prices hovering between $50 and $60 per barrel, returns could be slow and politically risky. Until Venezuelan crude begins flowing at scale, the country remains the world’s ultimate oil paradox—immensely wealthy in resources, yet trapped by years of economic and institutional collapse.

For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest World on thefoxdaily.com.

COMMENTS 0